Mexico Outlook

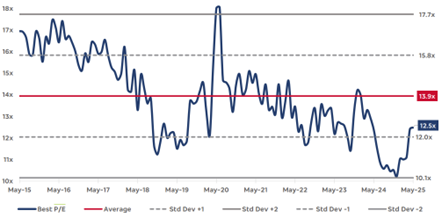

After a year marked by volatility, political transition, and tariff noise, the fundamental case for Mexico and nearshoring remains firmly in place. Contrary to common perception, we believe Mexico is not retreating from nearshoring; it is merely taking a pause. While headlines might suggest nearshoring has run its course, they largely overlook the fundamentals of what is taking place. Commensurately, Mexican equity valuations compressed to extreme levels by late 2024, as the Mexican equity market traded at a 15-year low, according to Bloomberg. While through the first half of 2025 valuations rebounded from the trough level, Mexican equities remain attractive, trading near one standard deviation below the 10-year forward P/E average. Even with recent tariff announcements on Mexico by the United States, Mexico’s effective US tariff rate remains only at 2.3%, compared to an average of 10.1% for the rest of the world, as per the Yale Budget Lab. This reinforces Mexico’s relative advantage even within the current framework. As such, we believe the current disconnect between sentiment and fundamentals offers a compelling opportunity.

Exhibit 1: Valuations (10-year fwd. P/E)

Sources: Bloomberg, Bradesco BBI

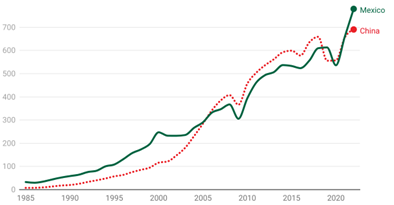

The current valuation disconnect, in our view, overly discounts Mexico’s geopolitical position and the nearshoring opportunity for the country. Nearshoring remains central to Mexico’s investment case, shaped by evolving trade realignment. Shifts in historic trade partnerships, such as Mexico surpassing China as the United States’ top source of imports in 2023 and elevated US-China tensions, should allow Mexico to position itself as the preferred regional hub. Mexico remains essential to US supply chains, with cost advantages, logistical proximity, lower wages, and preferential trade terms under the United States-Mexico-Canada Agreement (USMCA).

Exhibit 2: Share of US Total Imports ($bn Nominal Basis)

Sources: US Census Bureau, Monday Morning Economist

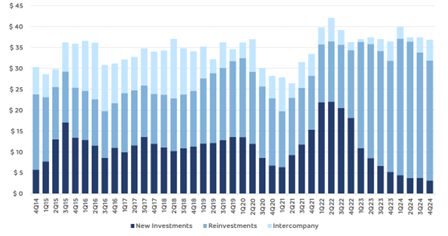

Foreign companies already located in Mexico are deploying capital and expanding their footprint. These include investments of $15 billion from Mexico Pacific, $5 billion from Amazon, and $4 billion from DHL, as per Reuters, as well as $18 billion from Japanese auto suppliers, according to the Financial Times. Surprisingly, reinvestment accounted for 80% of 2024’s total FDI. Moreover, in Q1 2025, total FDI into Mexico reached $21.4 billion – representing a 5% YoY increase and a record high, in spite of fewer new entrants.

Exhibit 3: Mexico FDI (US$ bn, Quarterly) – Decline in New FDI Was Offset by Reinvestments

Sources: Ministry of Economy, Bradesco BBI

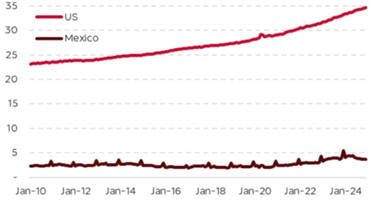

Mexico’s position is further justified by preferential logistics and cultural advantages compared to many historical trading partners of the US. Mexico’s geography offers a clear logistical advantage over competitors. Overland shipping from Mexico to the US takes between two to five days, in contrast to multi-week shipments from Asia. This proximity not only shortens supply chains but also reduces risk and improves inventory management capability. Labor cost competitiveness also adds to the appeal. Despite multiple rounds of minimum wage increases, Mexico’s average manufacturing wage remains at $4.90 per hour, below China at $6.50 per hour and even more so the US, where manufacturing wages often exceed $30 per hour. Moreover, we believe demographic and economic alignment with many US industries further differentiates Mexico, as they have a younger and increasingly skilled workforce aligned with sectors like automotive, aerospace, and electronics. Given that approximately 80% of US workers are employed in services, as per the US Bureau of Labor Statistics, this contrast creates a highly complementary bilateral relationship.

Exhibit 4: The Manufacturing Wage Gap (Hourly Manufacturing Wage in US$)

Sources: MSCI, Bloomberg, Bradesco BBI

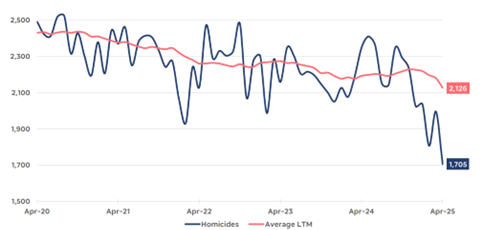

Mexico’s President Sheinbaum has taken a largely pragmatic approach to US relations. Rather than embracing reactionary policy, her administration’s approach has remained measured regarding President Trump’s tariffs. Recent initiatives are largely supportive of US initiatives on immigration, drug trafficking, and border security. Reuters reports that fentanyl trafficking from Mexico to the US fell by 40% from January to June 2025, in addition to declining homicide rates. These efforts not only reiterate Mexico’s image as a more relatable and reliable partner, especially compared to China, but also further foster the relationship development through the USMCA, which is due for a review.

Exhibit 5: President Sheinbaum’s Actions Started to Make an Impact – Victims of Homicide in Mexico

Sources: Ministry of Public Security, Bradesco BBI

In spite of the supportive data points for improvements, President Trump declared a 30% tariff rate for Mexico, effective August 1st, due to a lack of security on the border. According to Bloomberg, the US does not intend to apply the 30% rate to USMCA-compliant goods, citing a White House official. The bottom line is that this would equate to an approximate 5% increase on goods that are neither USMCA-compliant nor impacted by global sectoral tariffs. In the grand scheme of things, this is rather minor, as per Bloomberg, over 80% of US-Mexico trade now happens within the USMCA framework. Additionally, there could be scope to negotiate this down prior to August 1st. While the announcement is incrementally negative from a sentiment perspective, we do not believe that it changes much from a fundamental perspective.

Since the USMCA replaced NAFTA in 2020, trade between the US and Mexico has surged nearly 50% according to Mexico’s Economy Ministry. Moreover, President Trump himself originally signed the USMCA into law, calling it “the best trade deal we have ever made.” The US to a large extent depends on Mexico, as 15% of US imports come from Mexico, as per Jefferies. More interestingly, Mexico stands as the top trading partner for many southern Republican-led states, in which any disruptions to the status quo could prove damaging to the 2026 US midterm elections outcome. Ultimately, while some concerns remain, such as auto content rules, they do not undermine the broader reasoning for the agreement.

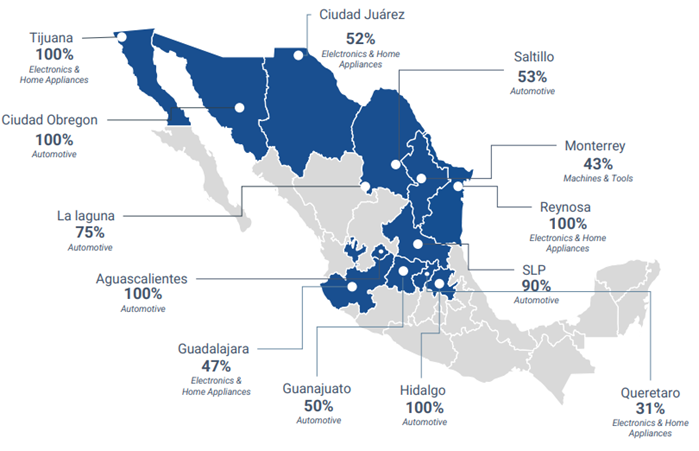

Complementing these external efforts, President Sheinbaum’s administration has also advanced internal policy initiatives such as “Plan México.” It includes 15 tax-incentivized industrial zones, aligned to underpin key industries represented in US-Mexico trade. Amongst the industries poised to benefit are automotive, logistics, and aerospace. The automotive industry has been the leading driver of nearshoring activity, accounting for 39% of accumulated nearshoring demand by the end of 2024. For context, the main nearshoring clusters are concentrated in northern, eastern, and central Mexico, with key cities being Monterrey, Tijuana, and Ciudad Juárez. To support development in these sectors, “Plan México” also aims to double clean energy capacity by 2030, from 80 to 156 TWh, easing infrastructure bottlenecks.

Exhibit 6: Nearshoring Share by Industry in Main Markets

Sources: CBRE Research 2024, FIBRA MTY

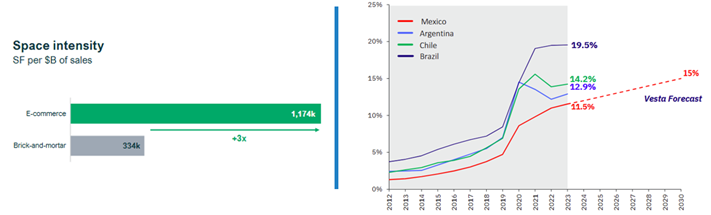

As these infrastructure efforts materialize, we highlight Vesta as a clear beneficiary of nearshoring. As a leading industrial real estate development company, Vesta has one of the largest and most modern property portfolios in Mexico, with diversified exposure to high-quality tenants. Additionally, Vesta continues to expand its footprint through their strategic plan “Route 2030”, by accelerating its land bank across core markets such as Monterrey, Guadalajara, and Mexico City. The company is well-positioned to capitalize on increasing rent prices and growing demand for industrial space, driven by manufacturing, logistics, and e-commerce. Vesta trades at an attractive 9.6% 2026 cap rate as of 2Q 2025, according to Itau. We believe that at current valuations, the market is yet to price in the future project developments supported by nearshoring.

Exhibit 7: Space Intensity of E-commerce and E-commerce Penetration Outlook

Sources: Euromonitor, Census Bureau, Prologis Research; Euromonitor, Projections based on Vesta and LENS

In spite of the nearshoring developments, Mexican GDP growth in 2025 is expected to be subdued due to the lack of social spending post-Mexican elections. The economic growth projections for the country appear stagnant, yet while counterintuitively, it would not be accurate to assume the same holds for Mexican equities. Mexican equities have nearly doubled in US$ terms over the past three and a half years, yet without valuation re-rating, meaning the performance had been almost completely underpinned by earnings growth, as per BTG Pactual. Many Mexican companies have an extremely resilient earnings base, as they operate in industries with limited competition or have a meaningful earnings contribution from other countries.

As such, another opportunity we highlight is Arca Continental, one of the leading Coca-Cola bottlers in Latin America. With a footprint of over 128 million customers across Mexico, the US, and South America, Arca stands to benefit as Mexico has the highest per capita consumption of Coca-Cola globally, according to the Economic Times. To meet growing demand for soft drink products in Mexico, the company plans to open six new production lines in 2025. Moreover, the company continuously expands its umbrella of brands beyond Coca-Cola, and now distributes over 160 brands, including Topo Chico, Sprite, Monster, and Powerade.

Ultimately, as outlined, we believe there is a significant disconnect between market sentiment and fundamentals. While tariffs have contributed to volatility in the markets, the investment case for nearshoring remains intact and underappreciated. We believe that resilient FDI and competitive advantages in labor and logistics continue to reinforce Mexico’s role in the evolving global supply chain. We have identified several bottom-up opportunities, and as such, we are overweight Mexico. Additionally, DRZ Emerging Markets Value Portfolio Manager, Marc Miller, recently met with management teams across the real estate and industrial sectors. These first-hand insights further validate our view that the market is yet to fully recognize the breadth of the opportunity. In our view, nearshoring is not dead; it has merely taken a siesta.

Left Photo: Marc Miller (right) meeting with Vesta CEO; Right Photo: Marc Miller (4th from the left) meeting with Fibra MTY CEO

- DRZ Emerging Markets: Nearshoring Is Not Dead

- DRZ Emerging Markets: India Outlook

- Emerging Markets: Key Themes Across Latin America and China

- DRZ’s Marc Miller Discusses Emerging Markets Value with Daymer Bay Capital

- DRZ Investment Advisors’ New Brand Identity Ushers In a New Era of Advice and Focuses on Legacy of Value